The Power of Dividend Reinvestment Plans (DRIPs)

Investing is a long-term game, and one of the most powerful yet underrated strategies is dividend reinvestment. A Dividend Reinvestment Plan (DRIP) allows investors to automatically reinvest their earned dividends into additional shares of stock instead of taking them as cash payouts. Over time, this simple strategy leads to the compounding of returns, helping investors grow their wealth significantly.

In this article, we’ll explore:

How DRIPs help compound returns

The benefits of automatic reinvestment vs. taking cash payouts

Why long-term investors should consider reinvesting dividends

By the end, you’ll understand how DRIPs can turn modest investments into substantial wealth over time.

1. How DRIPs Help Compound Returns

At its core, a DRIP allows dividends to be reinvested into more shares, which then earn additional dividends, leading to an exponential compounding effect.

The Power of Compounding in Dividend Investing

The compounding process is simple:

You buy shares of a dividend-paying stock.

The stock pays out dividends.

Instead of receiving cash, the dividends are used to purchase more shares.

Those additional shares generate their own dividends.

This cycle repeats over time, leading to accelerated growth.

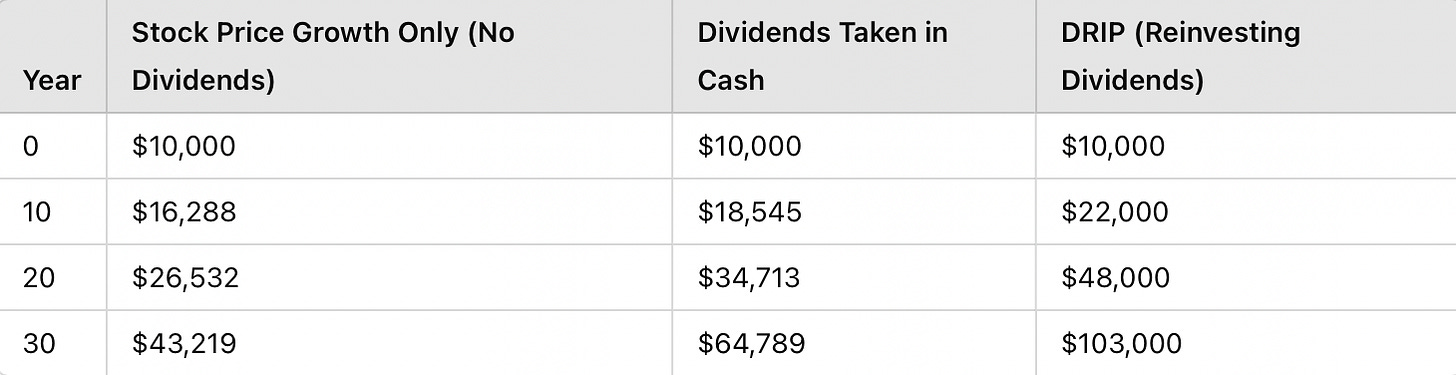

For example, suppose you invest $10,000 in a stock with a 4% annual dividend yield and 5% annual stock price growth. Here’s how your investment grows under different scenarios:

As you can see, reinvesting dividends more than doubles the final value compared to just taking cash payouts.

Why Does This Happen?

More Shares Over Time – Since you buy additional shares with dividends, your total holdings increase each year.

More Dividends – Each new share earns its own dividend, adding to the compounding effect.

Market Growth – Over the long term, stock prices generally appreciate, making reinvested shares even more valuable.

This simple reinvestment strategy is why many long-term investors choose DRIPs as a cornerstone of wealth-building.

2. Automatic Reinvestment vs. Taking Cash Payouts

Investors have two choices when receiving dividends:

Automatically reinvest them (DRIP).

Take them as cash payouts for immediate spending or reinvestment elsewhere.

Let’s analyze the advantages and disadvantages of each.

Option 1: Automatic Dividend Reinvestment (DRIP)

Pros:

✅ Compounds Over Time – Allows dividends to generate additional dividends.

✅ Cost-Effective – Often commission-free and fractional shares can be purchased.

✅ Hands-Free Investing – Requires no effort or market timing.

✅ Takes Advantage of Market Fluctuations – When stock prices dip, dividends buy more shares at lower prices.

Cons:

❌ No Immediate Cash Flow – Investors who need passive income won’t benefit from reinvestment.

❌ Taxable Event – Even if dividends are reinvested, they are still taxed (unless in a tax-advantaged account like a Roth IRA).

❌ Less Portfolio Diversification – Ties capital to one stock instead of spreading it.

Option 2: Taking Cash Payouts

Pros:

✅ Provides Passive Income – Useful for retirees or those who want extra cash.

✅ Gives Investment Flexibility – Cash can be reinvested elsewhere or used for other financial needs.

✅ No Forced Reinvestment in One Stock – Allows rebalancing into different assets.

Cons:

❌ Slower Growth – Compounding benefits are lost if dividends aren’t reinvested.

❌ Reinvestment Requires Effort – Cash must be manually reinvested, adding complexity.

❌ Market Timing Risk – Deciding when and where to reinvest can lead to missed opportunities.

Which Option is Best?

For long-term wealth building: DRIP is the superior strategy.

For retirees needing income: Taking cash payouts is more practical.

For diversified investing: A hybrid approach—reinvesting some dividends while using others for diversification—can be effective.

Ultimately, the decision depends on an investor’s financial goals and time horizon.

3. The Long-Term Benefits of Reinvesting Dividends

The longer you reinvest dividends, the more powerful the compounding effect becomes.

Key Benefits of DRIPs Over Time

✅ Accelerated Wealth Growth – Even small investments grow substantially when left to compound.

✅ No Emotional Investing – Eliminates the temptation to sell dividends during market dips.

✅ Fractional Share Advantage – Allows reinvestment of every dollar, maximizing returns.

✅ Takes Advantage of Bear Markets – Buying more shares during downturns results in higher future returns.

Historical Evidence of DRIP Effectiveness

Consider the S&P 500’s historical returns.

The S&P 500’s average annual return (1926–2023) is ~10%.

However, without reinvesting dividends, the return drops to about 6-7% annually.

For instance, if you had invested $10,000 in the S&P 500 in 1980:

Without dividends reinvested: ~$640,000

With dividends reinvested (DRIP): $1.2 million+

The difference is staggering, proving how reinvesting dividends can double long-term returns.

How to Set Up a DRIP

Choose Dividend-Paying Stocks – Look for reliable companies with a strong dividend history (e.g., Dividend Aristocrats).

Check if a DRIP is Available – Many brokerage accounts and companies offer free DRIP programs.

Enroll and Automate – Set up automatic dividend reinvestment in your brokerage account.

Monitor Over Time – Review holdings, but avoid making frequent changes.

Why Every Long-Term Investor Should Consider DRIPs

Dividend Reinvestment Plans (DRIPs) are one of the most effective ways to build long-term wealth. By reinvesting dividends automatically, investors benefit from compounding returns, increased share accumulation, and exponential portfolio growth.

Key Takeaways:

✅ DRIPs accelerate wealth through compounding – More shares = more dividends = even more shares over time.

✅ Automatic reinvestment eliminates emotional investing – Ensures long-term discipline.

✅ Taking cash payouts is best for retirees – But reinvestment is ideal for long-term growth.

✅ The S&P 500 example proves DRIPs work – Over decades, reinvesting dividends doubles or even triples total returns.

For investors focused on long-term financial independence, a DRIP strategy can be game-changing. Whether investing in individual dividend stocks or index funds with dividend reinvestment, the key is consistency.

If you’re building a long-term portfolio, consider enrolling in a DRIP today. The earlier you start, the more powerful compounding becomes—turning small investments into substantial wealth over time.